Australian ETF distribution components now available for FY23/24

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Sharesight now has updated ETF distribution component information for the FY23/24 Australian tax year for the majority of ETF providers in Australia, including Betashares, Russell Investments, VanEck, iShares and Vanguard. This means that for most Australian ETFs, Sharesight users will not need to manually update their distribution components using Sharesight’s annual tax statement components form to ensure the cost base for these ETFs is correctly adjusted and recorded in their portfolio. To learn more about the importance of keeping accurate cost base records for your ETFs, plus how you can easily track this in Sharesight, keep reading.

AMIT tax components for Australian ETFs

ETFs (Exchange Traded Funds) are a type of unitised investment fund that can be bought and sold on stock exchanges such as the ASX. These funds often pay distribution income to shareholders throughout the financial year (typically quarterly) for any income earned by the fund.

Since 2016, Australian ETFs can be structured as Attribution Managed Investment Trusts (AMITs). AMITs are an evolution of the Managed Investment Trust (MIT) structure that allows trustees to ‘attribute’ taxable income to unit holders without the need to distribute that income immediately.

This means investors may need to record a cost base increase when the attributed taxable income exceeds the distribution paid to the unit holder during the financial year.

For tax purposes, it’s important for investors to keep accurate records of these cost base adjustments on ETFs in their portfolios, as the cost base factors into capital gains tax (CGT) calculations should these ETFs be sold.

AMIT tax components for FY23/24

Sharesight has loaded AMIT components for the following ETFs for the 2023-2024 financial year:

- STW

- DJRE

- E200

- Betashares

- Russell Investments

- VanEck

- Global X

- iShares

- Vanguard

Sharesight’s ETF distribution data

It's important to note that Sharesight receives estimates of the gross distribution values from the ASX when they are announced, however AMIT components are only finalised when fund managers know the breakdown of income earned by the trusts, and then they make these values available to unit holders by issuing year-end AMMA tax statements.

This means that the distribution values Sharesight receives from the ASX throughout the year do not contain AMIT component breakdowns. Sharesight has worked directly with the registries and fund managers involved to collect raw data for the majority of these AMIT trusts, which we then use to calculate the component values for individual ETF holdings.

For ETFs where Sharesight has data, users will be able to accept these values if they have not yet confirmed the distribution payment. For ETFs where users have already confirmed the payment or used the annual tax statement components form and want to return to the original values, clicking ‘Reset’ when editing the distribution will revert the data to the updated values we’ve received. This will also reset any file attachments on the payout, so please ensure you save and re-attach these.

You can see how this process works in Sharesight by viewing the video below on how to confirm the ETF distribution components in Sharesight, before running the taxable income report to ensure the values match your AMMA statement.

How AMIT cost base adjustments impact performance

Sharesight takes into account both AMIT cost base increase and decrease components when calculating investment performance. Here’s how it works in each scenario:

AMIT cost base decrease

When calculating performance, Sharesight adds the AMIT cost base decrease component to your gross dividend given that it represents cash received that was not attributed to you.

AMIT cost base increase

When calculating performance, Sharesight deducts the AMIT cost base increase from your gross dividend given that it reduces your attributed income to the net cash amount you actually received.

How to confirm Australian ETF tax components in Sharesight

Watch this video to learn how to confirm ETF tax components in Sharesight:

Simply the best portfolio tracker for Australian investors

Join thousands of Australian investors already using Sharesight to manage their investment portfolios. Sign up for Sharesight you can:

-

Automatically track your dividend and distribution income from stocks, ETFs, LICs and Mutual/Managed Funds – including the value of franking credits

-

Use the dividend reinvestment plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful tax reports to calculate your dividend income with the taxable income report

-

Plus calculate your CGT obligations with Sharesight’s Australian capital gains tax report and unrealised capital gains tax report

To get started for FREE, simply sign up, import your holdings and watch as dividends and prices are automatically updated. If you decide to upgrade, you’ll unlock advanced features and everything you need to run your tax reports and gain unparalleled insights into your portfolio performance throughout the year.

Plus, as an Australian tax resident, you can save even more by claiming your Sharesight subscription fees on your tax return.1

FURTHER READING

1 If you derive income from the share market, your Sharesight subscription may be tax deductible. Check with your accountant for details.

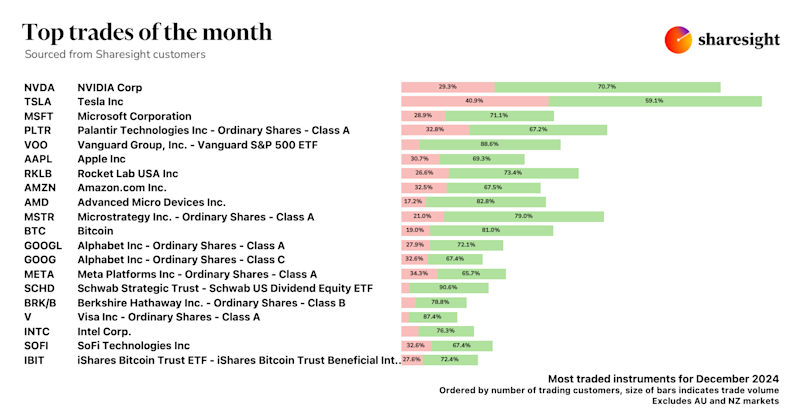

Sharesight users' top trades – December 2024

Welcome to the December 2024 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

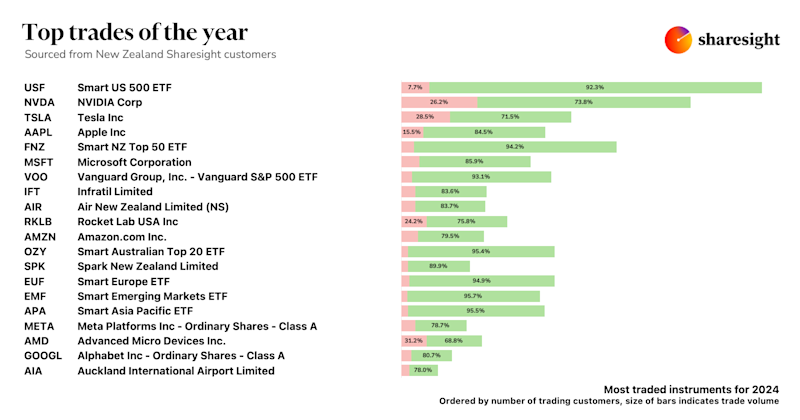

Top trades by New Zealand Sharesight users in 2024

Welcome to the 2024 edition of our New Zealand trading snapshot, where we dive into this year’s top trades by Sharesight users.

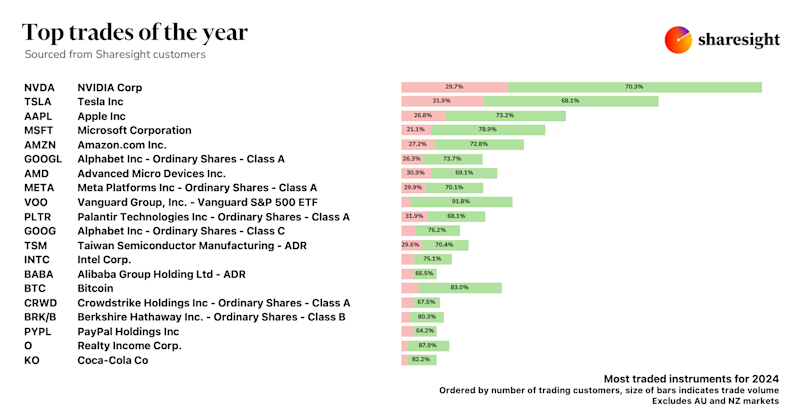

Top trades by global Sharesight users in 2024

Welcome to the 2024 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.