Attribution Managed Investment Trust tax calculations

This post is from 2018, Sharesight has updated AMIT ETF distribution information for ETFs and Funds for the 2020/2021 tax year.

This is the time of year when investors will be receiving their annual year-end tax statements from both listed and unlisted investment trusts, such as ETFs and managed funds. If you have had a close look, you will likely find some significant changes for the 2018 tax year.

Australian investors face some new and potentially complex tasks when completing the Tax Return for Individuals 2018 for the Australian Taxation Office (ATO), particularly if they earn income from managed trusts.

In 2016 the Australian Government introduced new laws that changed the taxation of Managed Investment Trusts (MITs), in particular the treatment of tax-deferred income. This created a new trust structure known as an Attribution Managed Investment Trust (AMIT) which has new tax implications for investors.

Fortunately Sharesight handles the changes to trust taxation introduced with Attribution Managed Investment Trusts. If you record the AMIT cost base increase and decrease components for AMIT holdings, Sharesight will correctly adjust the cost base and takes this into account when you run Sharesight’s Capital Gains Tax Report and Taxable Income Reports.

What is an Attribution Managed Investment Trust (AMIT)?

To understand Attribution Managed Investment Trusts, let’s start with what Managed Investment Trusts (MITs) are. A MIT is a trust structure that allows investors to purchase ‘units’ in the trust as a vehicle to the investment activities the trust undertakes. Typically Managed Investment Trusts will invest in shares, bonds, or property, with the income earned from those investments distributed to unit holders. MITs are considered trusts and income earned is taxed according to Division 6 of the Income Tax Assessment Act 1936.

In 2016 the Australian Government sought to make changes to the taxation of trusts to make Managed Investment Trust administration simpler, reduce administration costs and make the sector more competitive internationally. To do this MITs became a distinct trust structure, that would no longer be taxed the same as a traditional trust -- such as a family trust. The new structure is known as an Attribution Managed Investment Trust (AMIT).

Existing MITs that elected to apply to the regime can become Attribution Managed Investment Trusts. Under this regime trustees can now “attribute” taxable income to investors, without the need to make a distribution payment to unit holders. In effect, AMITs no longer need to pass through all the income immediately, as is the case with traditional trusts.

These attribution changes mean that under the AMIT regime there are changes to how the cost base is handled. Previously MIT taxation only allowed unit holders to record cost base decreases for CGT-exempt or tax-deferred payments. Under the AMIT regime it is now possible to record a cost base increase for units in cases where the “attributed” (which is where the A in AMIT comes from) taxable income exceeds the distribution paid to the unit holder. This will occur in cases where income is reinvested by the trust.

How Sharesight makes AMIT tax calculations easy

Sharesight has custom fields that allow AMIT unit holders to correctly record the Trust Income components for these investments. This includes fields for the new AMIT cost base decrease, and AMIT cost base increase adjustments which feed into both Sharesight’s Capital Gains Tax report calculations and the Taxable Income Report for Australians completing their Tax Return for Individuals 2018 form.

Below is a real 2018 AMMA (AMIT Member Annual) statement that breaks down the multiple trust income components required by the ATO. Once entered into the corresponding fields in Sharesight (shown) the rest is easy:

IMPORTANT: When you receive your AMMA statement, make sure you double check the component breakdowns against the values automatically suggested by Sharesight, as these values are likely to be updated in the year-end tax statement and won’t include any AMIT cost base increase or decrease that applies.

Sharesight now has updated year-end values available for ETFs on the Computershare registry that you can double check against your statements, but for trusts on other registries it is important to update these values manually yourself. Distributions that do not yet have updated component values are marked with a warning icon per the screenshot above.

How AMIT cost base adjustments impact investment returns

Sharesight takes into account both AMIT cost base increase and decrease components when calculating investment performance. Here’s how it works in each scenario.

AMIT cost base decrease

When calculating performance Sharesight adds the AMIT cost base decrease component to your gross dividend given that it represents cash received that was not attributed to you.

AMIT cost base increase

When calculating performance Sharesight deducts the AMIT cost base increase from your gross dividend given that it reduces your attributed income to the net cash amount you actually received.

Tax time webinar with PwC & Sharesight

Watch this webinar where PwC Partner Glen Frost & Director Tristan Whitefield & Sharesight CEO, Doug Morris answer your Australian tax time questions.

Embedded content: https://www.youtube.com/embed/56bbRYB4VXo

Simply the best portfolio tracker for Australian investors

Join thousands of Australian investors already using Sharesight to manage their investment portfolios. With Sharesight you can:

- Automatically track your dividend and distribution income from stocks, ETFs, LICs and Mutual/Managed Funds – including the value of franking credits

- Use the Dividend Reinvestment Plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

- See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful tax reports to calculate your dividend income with the Taxable Income Report

- Plus calculate your CGT obligations with Sharesight's Australian Capital Gains Tax Report and Unrealised Capital Gains Tax Report

To get started for FREE, simply sign-up, import your holdings and watch as dividends and prices are automatically updated. If you decide to upgrade, you’ll unlock advanced features and everything you need to run your tax reports and gain unparalleled insights into your portfolio performance throughout the year.

Plus, as an Australian tax resident, you can save even more by claiming your Sharesight subscription fees on your tax return1.

FURTHER READING

- 7 reasons why Sharesight is better than a spreadsheet

- Record-keeping requirements for Australian investors

- 5 ways to get the portfolio insights you need

1 If you derive income from the sharemarket, your Sharesight subscription may be tax deductible. Check with your accountant for details.

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

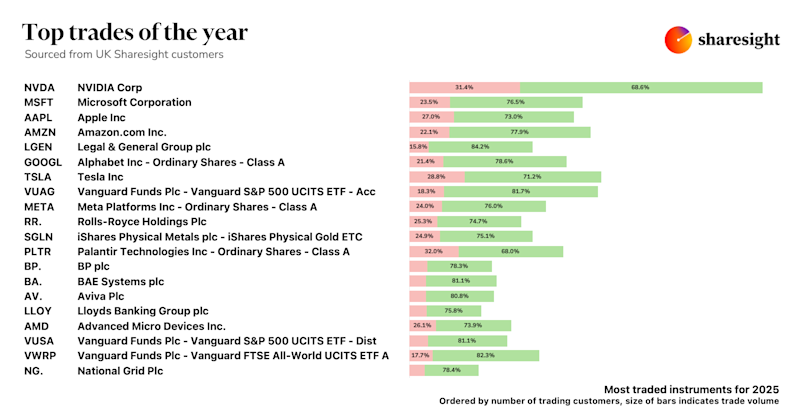

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

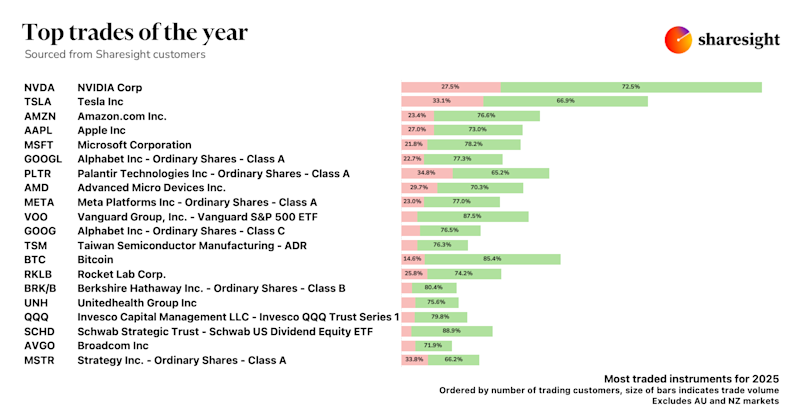

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.