ASX mFund distribution data now available in Sharesight

In order to improve the experience for investors that hold mFund investments, we have worked with the ASX to source and display mFund distribution data directly within Sharesight. The mFund settlement service allows investors to access unlisted managed funds through the ASX, and investors have been able to track mFund unit prices in Sharesight since the product launched in 2014.

Now Sharesight users will be able to see the total return on mFund holdings, including the impact of dividends and distributions on their performance, like they do for shares and managed funds. The addition of these distributions will enhance the experience of investors who access these managed funds via the ASX.

What is an mFund?

An mFund is an unlisted actively managed fund that is available to an investor through the settlement process of the ASX and is governed by the ASX's operating rules. mFund offers investors a wide variety of managed funds in a paperless format, giving them exposure to a wide range of asset classes and investment themes. To date, there are over 200 mFund listings on the market.

A number of brokers support and enable investors to buy and sell mFund holdings, including a number of broker partners of Sharesight such as CMC Markets.

Track your mFund holdings in Sharesight

With Sharesight, investors who hold mFund holdings may now view their total return alongside their other ASX (and non-ASX) investments such as shares and ETFs, giving them a holistic view of their investments.

"We welcome the new development by Sharesight to add distribution data for mFund to their platform. This new feature enhances an investor’s overall view of their portfolio and improves their experience when building portfolios using the products that are available on ASX" says Rory Cunnigham, Senior Manager, Investment Products at ASX.

We are now auto-populating corporate actions (dividends and distributions) for mFund instruments in Sharesight. Historical mFund distributions will be displayed under the corporate actions tab on each mFund holding.

Moving forward, all future mFund distributions will appear as unconfirmed payouts as with any other type of instrument.

Distributions for PMF04.MFU PIMCO AUSTRALIAN BOND FUND - WHOLESALE

Track all your investments in one place

You too can join thousands of Australian investors who already use Sharesight’s award-winning portfolio tracker to get the complete picture of their investment performance.

To get started, simply sign-up and import all your shares, managed funds and mFund holdings. Then watch as corporate actions such as dividends and distributions are automatically recorded and contribute towards your total return. We’re confident that you’ll agree that Sharesight is the best share portfolio tracker and tax solution for Australian investors available today.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

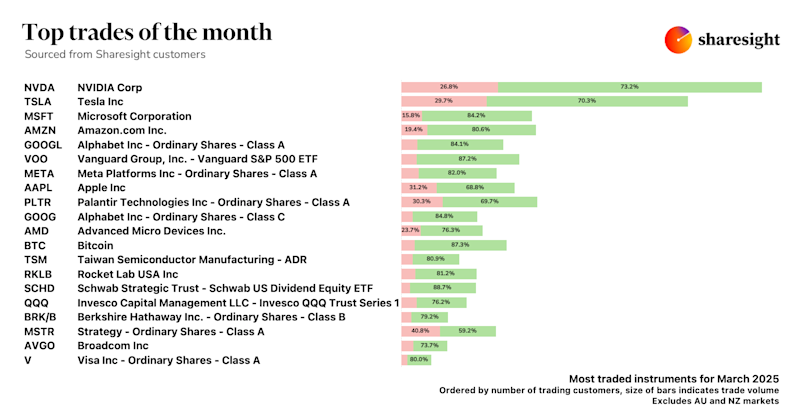

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.