See you at the ASA's Grow Your Portfolio conference 2016

On behalf of the Australian Shareholders’ Association, we're delighted to announce that Sharesight will be sponsoring and exhibiting at the 2016 Grow Your Portfolio conference, to be held 16-17 May at Sheraton on the Park, Sydney.

According to the ASA, they have "put together an impressive program with high calibre, thought-provoking speakers ensuring you receive the maximum return on your registration investment."

The comprehensive program includes the following streams:

- Buying and selling shares

- Investor’s toolkit

- Investor’s opportunities

- Investor’s alternatives

Registrations are now open for the two day conference with an optional third day.

Register before 15 March 2016 to take advantage of the Early Bird price of $515 per person, which includes a discounted Green e-Membership to the ASA.

Find out the benefits of ASA membership.

Optional extras include the Conference Dinner, Investment Disruptors full day seminar on Wednesday 18 May and the following Site Tours:

- Lend Lease site tour -- tour Barangaroo site -- 18 May

- Stockland site tour -- 18 May

- Virtus Health site tour -- 18 May

- Woolworths site tour -- 19 May

There are a strictly limited number of places available for these Site Tours which will be allocated on a first come first served basis, and are only available to conference delegates and their partners.

Full details and more information about the conference are available on the ASA website.

We look forward to seeing you there!

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

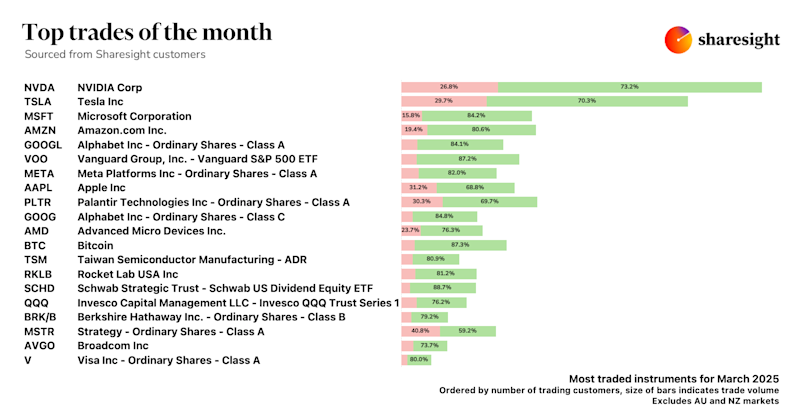

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.