A seriously flawed business model

In my previous blog I highlighted the need to invest in companies with a sound business model that is sustainable in the long term. Sounds good eh? But what the heck is a business model and how do you know if it is sound?

Well, and I’m sorry if you think this is a copout, the easiest way to answer the question is to discuss a business model that is demonstrably not sound. For example the one under which many, if not most, finance companies operate.

Finance companies do the same thing as the major trading banks – they lend money. So why have the big banks in NZ survived for many decades while finance companies fall over at regular intervals and have unacceptably short life spans? It’s all to do with the business model under which they operate.

In essence the major banks adopt a business model that calls for a risk profile that gives them a good chance of surviving a 1 in 50 or 1 in 100 year business downturn. On the other hand one could be forgiven for wondering whether some finance companies have any sort of risk strategy at all let alone clearly articulated business model. If they do, it is obviously calibrated, whether they realise it or not, to survive a 1 in 5 or 1 in 10 year downturn but not much more. This is just not good enough.

A number of finance companies demonstrated their inadequate business models very graphically in the late 1980’s and early 1990’s by collapsing and, for reasons best known to themselves, a further 20+ finance companies have decided to prove that history does repeat by collapsing over the last 2 years or so.

Put simply, the finance company business model involves lending money in circumstances that the major banks deem to be too risky. It is profitable business when the economy is booming but it is a recipe for disaster when one of the inevitable low points in the economic cycle arrives.

If you doubt what I’m saying look at the excuses finance companies trot out when the proverbial hits the fan. For example ‘Hanover, a New Zealand business with the size and strength to withstand any conditions’ is at a "standstill.” Apparently this is as a result of a number of factors, including a loss of investor confidence in the finance sector, a weak property market and the global credit crunch. These things have occurred repeatedly in the past and will do so again and, despite what the finance companies claim, they are not the problem. The problem is that their business models have not been designed to cope with them.

Hanover is not the only failed finance company to blame the property market. Some finance companies have a large percentage of their book exposed to property development. Others have a huge exposure to second-hand cars. And it is not uncommon for them to have 30-40% of their lending exposure to one or two clients.

Compare this with a major bank whose business model would severely restrict, if not totally forbid, any exposure to property development or second-hand cars and would not countenance an exposure of even 1% of its book to a single client let alone 10, 20 or 30%. And if the Banks do finance property development, you can bet your bottom dollar their business model will require first ranking security: not the second or third ranking position finance companies seem happy to accept.

Another crucial thing is that Reserve Bank demands that the major banks’ business models include sufficient equity to cover the losses that might occur in a serious downturn. This is not demanded of finance companies. It will be interesting to see whether the Hanover shareholders, who have the personal resources to inject enough equity to cover investor losses, actually do so.

There’s a lot more to a comprehensive business model than what I have mentioned of course. But the point is that, almost by definition, finance companies are likely to have a flawed business model with an unacceptably high credit, liquidity and operational risk profile. Otherwise they would end up in the same space as the major banks where they simply would not be able to compete.

I know it is a bit late now to say don’t invest in finance companies but if you are lucky enough to still be around for the next finance company boom in 10 years time or whenever, you will see history repeat - again. My advice is don’t be tempted to join the high flyers: keep your feet firmly on the observation deck.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

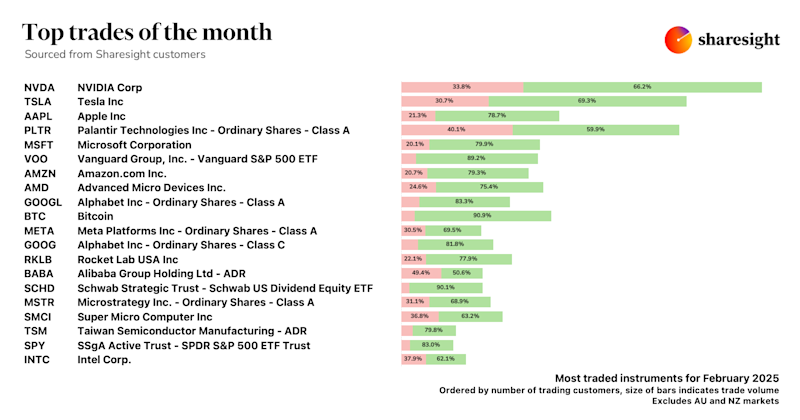

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.