6 reasons why Canadian investors love Sharesight

Sharesight is the award-winning portfolio tracker that automatically calculates your total annualised performance -- including brokerage fees, dividends, and currency fluctuations (something brokers and spreadsheets don’t do). Investors in over 100 countries trust Sharesight to track the performance of their investments, but there are a few features that we built specifically with Canada in mind.

If you’re a Canadian investor, here are six reasons why you’ll love Sharesight:

-

Calculate your CGT with the Canadian Capital Gains Tax Report

-

Keep your portfolio up-to-date by forwarding your trade confirmations

1. Track your Canadian stocks and mutual funds

Sharesight lets you track stocks and listed bonds from over 60 global stock exchanges, including the following Canadian markets:

-

CNSX - Canadian Securities Exchange

-

CVE - Toronto TSX Ventures Exchange

-

TSE - Toronto Stock Exchange

Plus Sharesight lets you track over 40,000 Canadian mutual funds, including 10 years of historical price and distribution data. Ongoing prices & distributions are automatically updated and editable at any time.

2 Easily import historical trades from Canadian brokers

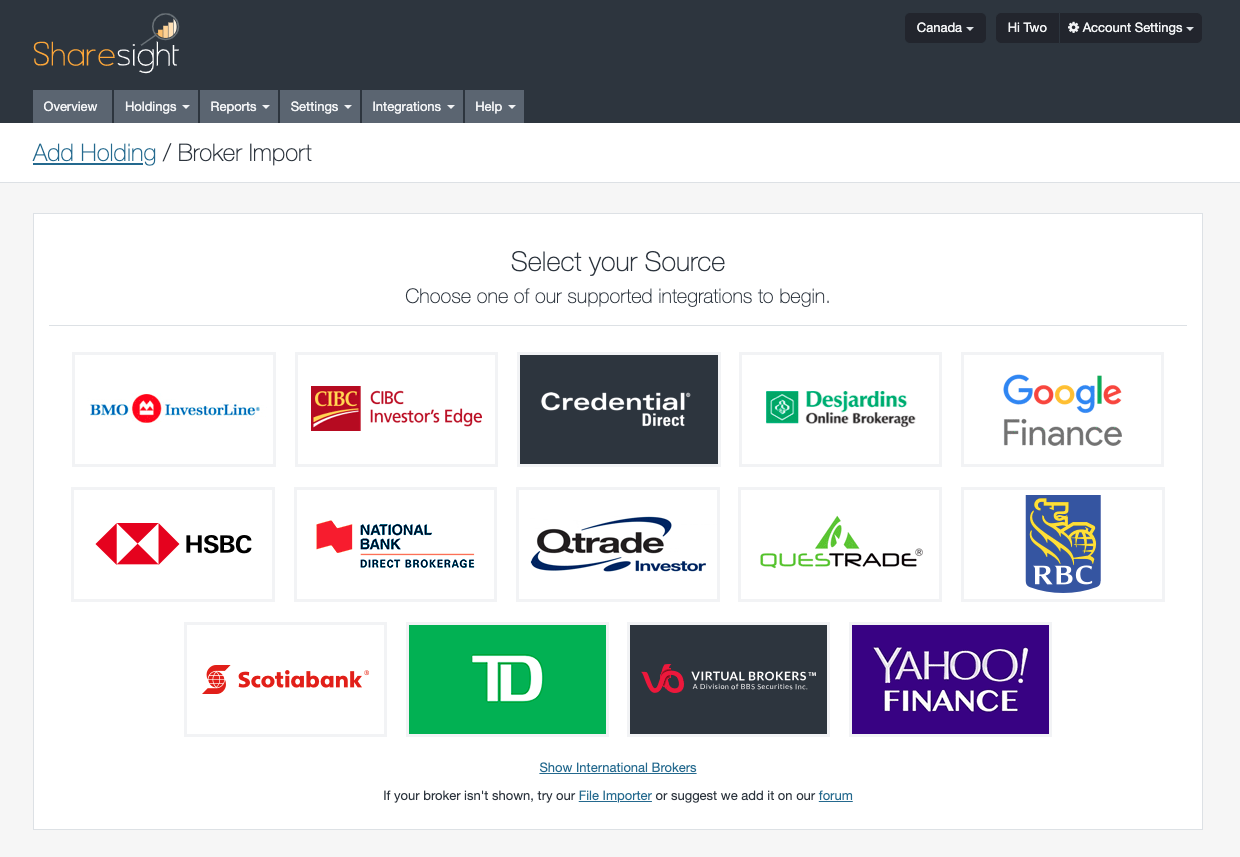

Getting your portfolio data into Sharesight is easy. Most Canadian brokers - including Questrade and Scotiabank - allow you to download a CSV file of your historical trades from their client portals. You can then easily import the data into Sharesight in just a few clicks. And there’s no need to worry about corporate actions such as dividends and share splits. Sharesight will automatically suggest these for you, so all you need to do is confirm or edit them, and you’re good to go.

Easily import historical trades from Canadian brokers

For more detailed instructions on how to import your trades from the supported Canadian brokers below, click on the links below or visit this page.

-

Canadian ShareOwner Investments Inc

-

Credential Direct

-

Desjardins Online Brokerage

-

Royal Bank of Canada (RBC Direct)

-

Scotia Wealth Management

-

Shareowner

3. Track your registered and non-registered accounts

If you have a mix of RRSP, RRIF, TFSA and/or non-registered investment accounts, you should track them separately as they have different tax rules. Sharesight lets you track multiple portfolios under one account, so you can easily track your registered and non-registered tax entities in separate portfolios.

When you set up a Sharesight portfolio with the tax residency set to "Canada", you have the choice of the following tax settings which conform to Canadian Revenue Agency (CRA) tax reporting rules:

| Tax Entity Type | Notes |

|---|---|

| Non-registered | Standard tax rules apply. |

| Registered Retirement Savings Plan (RRSP) | Non-resident withholding tax does not apply for US stocks. |

| Registered Retirement Income Fund (RRIF) | Non-resident withholding tax does not apply for US stocks. |

| Tax-Free Savings Account (TFSA) | Income from Canadian investments will be treated as non-taxable by default and not appear on the Taxable Income Report. Non-resident withholding tax still applies. |

The benefit of tracking your portfolios in Sharesight is that you can see all your investments in one place instead of having to look for them across various banks and brokers. Take it one step further by grouping your portfolios into a consolidated view, then run a performance report to get a holistic view of your investments and how you’re doing overall.

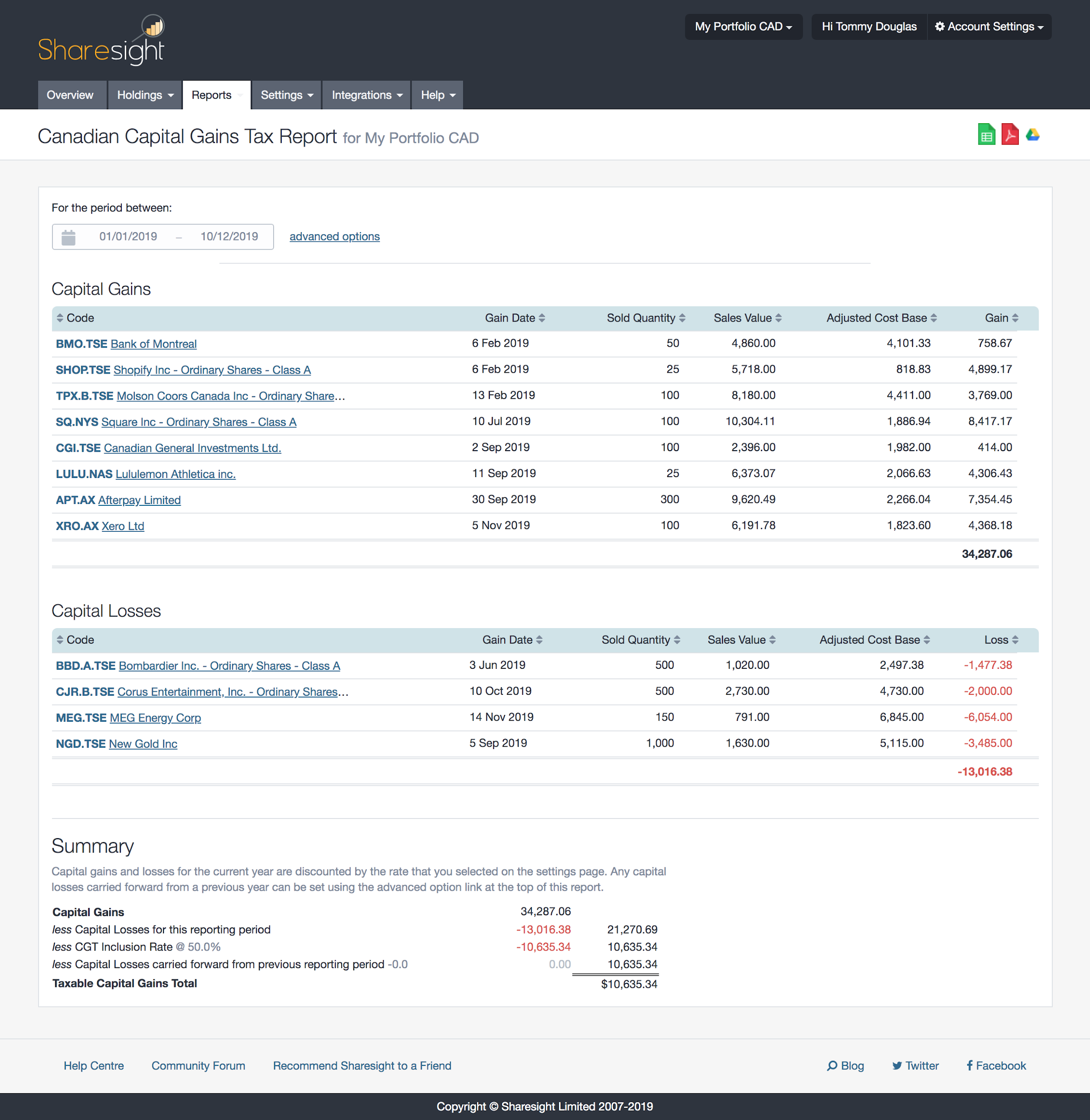

4. Calculate your CGT with the Canadian capital gains tax report

Sharesight’s Canadian CGT report calculates capital gains (and losses) made on investments according to Canada Revenue Agency (CRA) rules, and is available in our Investor and Expert plans:

With your capital gains and losses automatically sorted, you’ll save money on accounting fees at tax time. You can download your CGT report to PDF, Excel, or Google Sheets and send it to your accountant (or better yet, securely share your portfolio directly with your accountant so they have everything they need at their fingertips – not just at tax-time but throughout the year).

5. Keep your portfolio up-to-date by forwarding your Trade Confirmation Emails

Keeping your portfolio up-to-date with your latest trades is a crucial step to staying ahead of your portfolio admin, as it ensures that your performance figures are accurate and allows you to make timely data-driven investing decisions. If your online broker provides you with trade confirmation emails (also known as a contract note), then you can send those emails to Sharesight and we’ll "read" them and add the trades to your portfolio. It’s just a matter of forwarding the emailed PDFs to us, or including Sharesight as a recipient on your trade confirmation emails. Sharesight currently supports contract notes from over 200 brokers worldwide, including the following Canadian brokers:

If your broker is not yet supported, you may manually add your trades for now, and get in touch with our support team so we can add your broker to the list.

6. Track your Canadian and foreign currency

View your complete financial position by tracking your cash alongside your listed investments. You can track over 100 global currencies (including the Canadian dollar) plus over 100 cryptocurrencies within Sharesight. Prices are updated every 5 minutes (20 minute delayed) and you can denominate brokerage fees in the currency being traded.

Simply the best portfolio tracker for Canadian investors

Thousands of investors like you are using Sharesight to simplify their tax reporting and discover the true performance of their investments. What are you waiting for? Sign up today and:

-

Track all of your investments in one place, including stocks, mutual funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual funds

-

Run powerful reports built for investors, such as performance, portfolio diversity, contribution analysis and future income (upcoming dividends)

-

Easily share access of your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.