5 ways Sharesight makes EOFY a breeze

Note: There is a newer version of this article: Making the most out of your Sharesight subscription at EOFY

Sharesight, by its very nature, is all about simplifying portfolio management. But with the end of financial year just around the corner, we thought we’d share some of the ways that Sharesight can act as your portfolio data “passport” and ease the burden at tax-time.

1. Rich Reporting

While our reports offer excellent day-to-day insights, they’re especially valuable this time of year. Sharesight provides reports on Taxable Income, Capital Gains Tax (CGT), Unrealised Capital Gains Tax, Foreign Investment Funds (FIF), Historical Cost, and many more. You can run any report you want, for any date range, and then view it on screen, or print or download it to Microsoft Excel or PDF. And if you’re an accountant or financial adviser on Sharesight Pro, you can even brand these reports with your company logo.

Regardless of whether you’re an individual or finance pro, Sharesight takes care of the number crunching for you, so you can focus on more important things such as budgeting and planning for the year ahead.

2. Sharing Portfolio Access

Another feature that comes in handy at tax time is ability to share a portfolio with anyone you’d like. For individuals, this can mean granting access to your accountant or financial adviser. With all your investments tracked in real-time (and even better yet, synced with Xero), they’ll have everything they need to prepare your tax documents. You’ll save time by no longer having to gather paperwork for them, and you’ll save money because they’ll have everything they need (in one place) to work quickly and efficiently.

As a professional using Sharesight Pro you can share access with your clients. So you can import clients' investment history and let them run their tax reports in their own time, or let them view their individual investments and portfolios in easy-to-read charts and graphs. You can even grant your staff access to client portfolios and delegate day-to-day maintenance in order to free up your time for higher-value activities, such as strategic planning. And while sharing access is particularly valuable come EOFY (both for individuals and financial professionals), we say why stop there? Sharing access all year means that everyone’s on the same page and can focus on what really matters. Remember, ring-fencing your clients will backfire in the long run.

3. The Past, Present, and Future

A Sharesight login comes equipped with 20 years of price, dividends, and corporate action history. This means you can go back in time to your first share purchases and track performance from that point forward until today. Sharesight will even populate your dividends and share splits along the way. No matter when you choose to start your portfolios though, the Sharesight reports will always be up to date. And while Sharesight automatically updates your portfolio at the close of trading each day, if you set up our Trade Confirmation Emails feature, we’ll track your trades automatically going forward and store copies of your Trade Confirmation Emails!

4. Managed Funds Tracking

In case you missed the news, we added support for nearly 10,000 managed funds back in February. From corporate superannuation to wholesale trusts, pension funds, KiwiSaver funds, even industry superannuation funds, Sharesight tracks daily unit prices and distributions for all sorts of Australian and New Zealand funds. To ensure you’re monitoring your complete investment mix, we recommend tracking your managed funds in Sharesight - especially if you own funds outside of your Superannuation that need to be reported on for tax purposes.

5. Sharesight Connect (Nerds love our APIs)

You can save even more time during the busy tax season (and throughout the year) by automatically importing your trade data from a Sharesight Connect broker partner. Popular brokers include CMC Markets in Australia and Direct Broking in New Zealand.

We hope you find these EOFY tips helpful. If you’re already a Sharesight client, make sure you’re leveraging our Help Documentation and Customer Forum to make the most of our features - not just at tax-time, but year-round. And if you haven’t yet signed-up for Sharesight, now’s the time to do it. The sooner you start tracking investments with Sharesight, the less paperwork you’ll have to chase next year. And you can even bring forward your tax deduction by claiming next year’s membership fee on this year’s tax return1.

1If you reside in Australia and derive income from the sharemarket, your Sharesight subscription may even be tax deductible. Check with your accountant for details.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

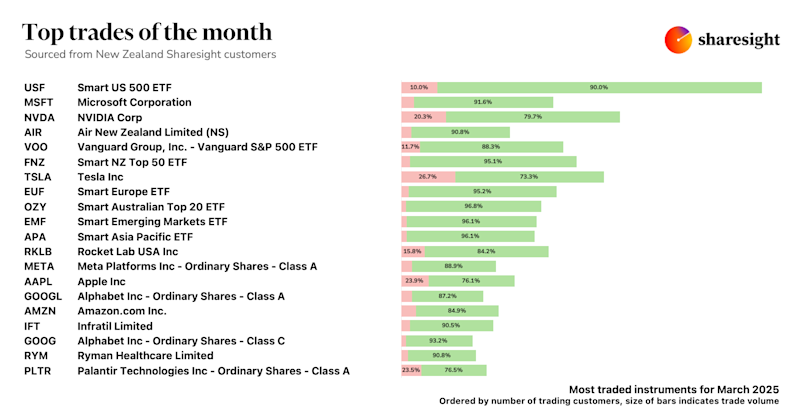

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

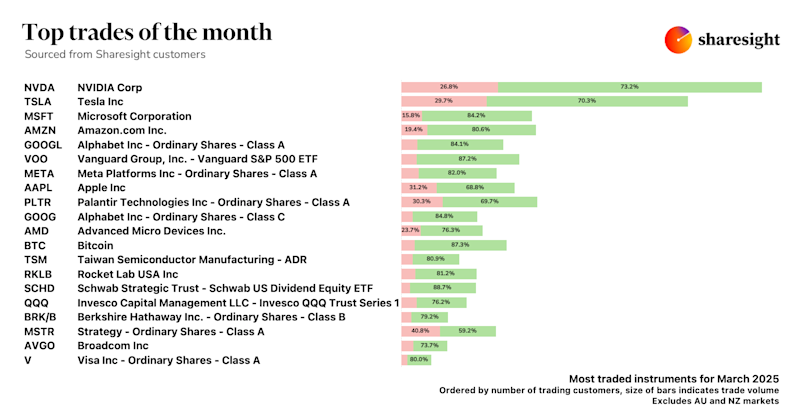

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.