4 ways to monitor the health of your portfolio

It’s a tense time for investors worldwide. News headlines are centered on the US-China trade war, Brexit uncertainties, and doomsday forecasts of crashing markets and a global recession. And on top of all that, the month of October has consistently taken the crown as the month with the most volatility, even when you remove the October 1929 and 1987 crashes. It’s no wonder that investors are on the edge of their seats.

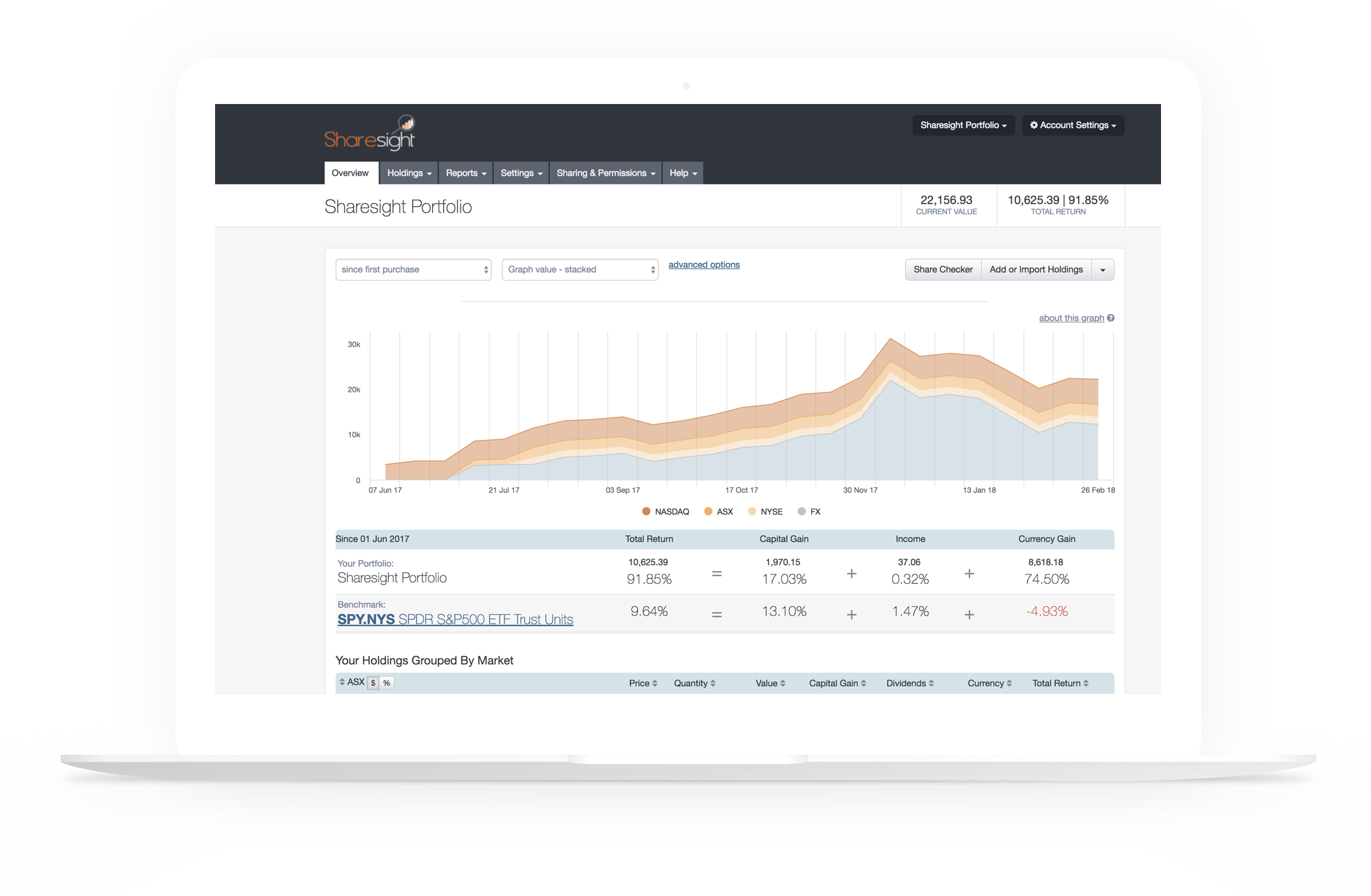

So, how does one keep from losing cool while the financial markets seem to be going rabid? Easy. Monitoring how your portfolio has been performing overall, not just in the last month, is the best antidote to help you remain calm and make the best decisions. What is portfolio monitoring and how you use it to your advantage? Learn more with these 4 ways to monitor the health of your investment portfolio:

1. Annualised Total Performance

Keeping track of your annualised total performance is essential as it helps you to understand how your investments are doing, thus helping you to make informed (rather than impulsive) decisions.

You must track everything.

If I asked you what your online brokerage account plus superannuation plus employee shares are worth, could you give me an accurate figure? Oftentimes, even those investors who think they know how they’re doing aren’t calculating their true returns. That’s because they rely on one or both of the following:

a) Relying on their broker

Broker performance figures are often just the difference between what you paid and since the latest market price. These figures aren’t right because:

- They don’t factor dividends (and dividend reinvestment plans) into your returns

- They don’t factor brokerage fees or currency fluctuations into your returns

- They don’t provide a total annualised return (a 20% return over five years is really only a 4% return per year)

b) Relying on a spreadsheet

I’m sure you don’t need me to tell you that tracking your investments on a spreadsheet is tedious manual work that is prone to errors. Just in case you’re a spreadsheet lover, and that one went in one ear and out the other, let me repeat: Tracking your investments on a spreadsheet to monitor your portfolio's performance does not guarantee you are calculating your true returns.

We used to love spreadsheets, too, but thanks to technology we have been able to improve these old systems. Isn’t it results that we’re all looking for? Replace your manual and labour-intensive spreadsheet with portfolio monitoring software that provides:

- Automatic updates

- Your true performance

- A visualisation of your portfolio

2. Dividend Yield

Dividends make up part of your performance returns; if you’re not tracking them, you’re not getting the full picture. This is especially true if you participate in a dividend reinvestment plan (DRP/DRIP).

Amazingly, most online brokers don’t factor dividends or DRPs into their return figures, meaning you are not getting a complete picture of your performance returns.

To be a successful investor with dividends in your portfolio, you must understand the following:

- How to properly track the funds you receive

- The tax implications

- The impact of dividend reinvestment

Sadly, tracking dividends is labour intensive and can be a severe pain in the neck. Again, portfolio monitoring software is the solution to these problems as we can now automatically receive dividend information from the share registries, including tax information and you can enrol an entire holding into a dividend reinvestment plan, or reinvest specific dividends. Nothing is left open to error.

3. Asset Allocation

Reviewing the impact of your asset allocation lets you understand the true drivers of your performance, be they stock selection, asset allocation, or exposure to certain countries, sectors, or industries. Asset allocation also helps you to easily compare and contrast the winners and losers in your portfolio – so you can make the most of your investments.

Diversification is an effective way to manage risk/return, limit exposure to any single asset and align your portfolio with the level of risk appropriate for your situation. You may be in a position to take riskier growth assets, or you may need to favour an asset mix of cash and defensive holding.

You should review your asset allocation across various dimensions including: Market, Sector classification, Industry classification, Investment type, Country, etc.

4. Benchmarking

Don’t compare your portfolios just against the major indexes you see in the news. Instead, track the performance of your portfolio against a market-tracking index ETF which provides a true apples-to-apples comparison -- incorporating the true costs of owning a portfolio that matches that index.

Benchmarking allows you to determine the relative performance of your portfolio compared to simply owning an ETF that takes much of the portfolio management out of your hands. You’ll understand whether you “beat the benchmark” or “beat the market”, and if not, it allows you to consider what else you could have done with your money.

For example, if you want to track the performance of your portfolio against your local market, select an ETF that is modelled on an index for that market (such as ASX: A200 for Australia, or TSX: XIC for Canada). If you’re an investor with an eye on portfolio diversification, you can even benchmark your portfolio against a model portfolio, such as one of Vanguard’s diversified index ETFs:

Why investors choose Sharesight

Embedded content: https://www.youtube.com/watch?v=lni4rGKxKC0

How to track portfolio performance (and keep your portfolio healthy)

Getting an accurate picture of the health of your investment portfolio can be tough with so many moving pieces to shuffle. Left to spreadsheets and third parties, you expose yourself to incomplete pictures of your portfolio, which can lead to poor decision making. Combine these four tactics, with portfolio management technology like Sharesight, to gain ultimate control of your investment portfolio. Keep your portfolio healthy -- sign up for Sharesight today.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.