4 ways to be a prepared investor this year

Investors, are you prepared for the year ahead? If you’re investing for the long-term, you may be tempted to ‘set and forget’ your portfolio, but by doing so, you could potentially miss out on some good opportunities to bolster your portfolio for the upcoming year. Without taking the proper steps to track your portfolio, you may also find yourself making uninformed and rash decisions that don’t fit your investing strategy and won’t help your performance in the long-run.

If you’re looking for some simple ways to improve your performance and strengthen your portfolio against market volatility, here are four ways Sharesight can help you become a more prepared investor.

1. Evaluate your investing strategy with powerful reporting tools

Perhaps it’s the beginning of the year and you’re looking to do an annual refresh of your strategy, or maybe you’re mid-way through the year and would like to rebalance your portfolio due to changes in market conditions. Whatever the case, it’s important to first get a picture of your portfolio’s asset allocation and diversification.

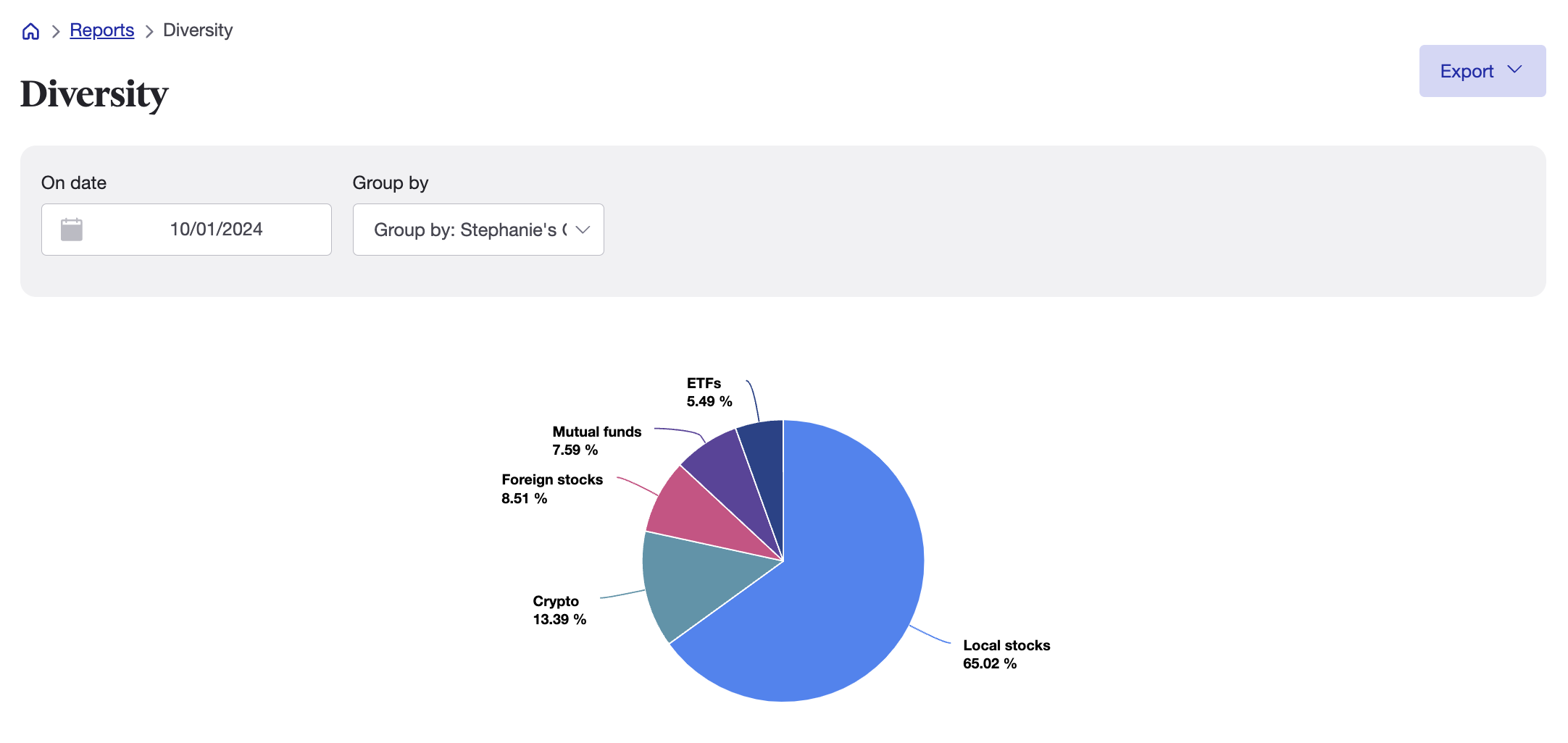

To determine your asset allocation, you can run Sharesight’s diversity report (available on Investor and Expert plans), which shows how your portfolio is diversified across different investment types, markets, countries, industries and sectors. You also have the option to create your own custom groups that reflect your specific investment strategy or asset allocation target.

By running the diversity report, you can see a clear breakdown of your portfolio’s asset allocation.

By running the diversity report, you can see a clear breakdown of your portfolio’s asset allocation.

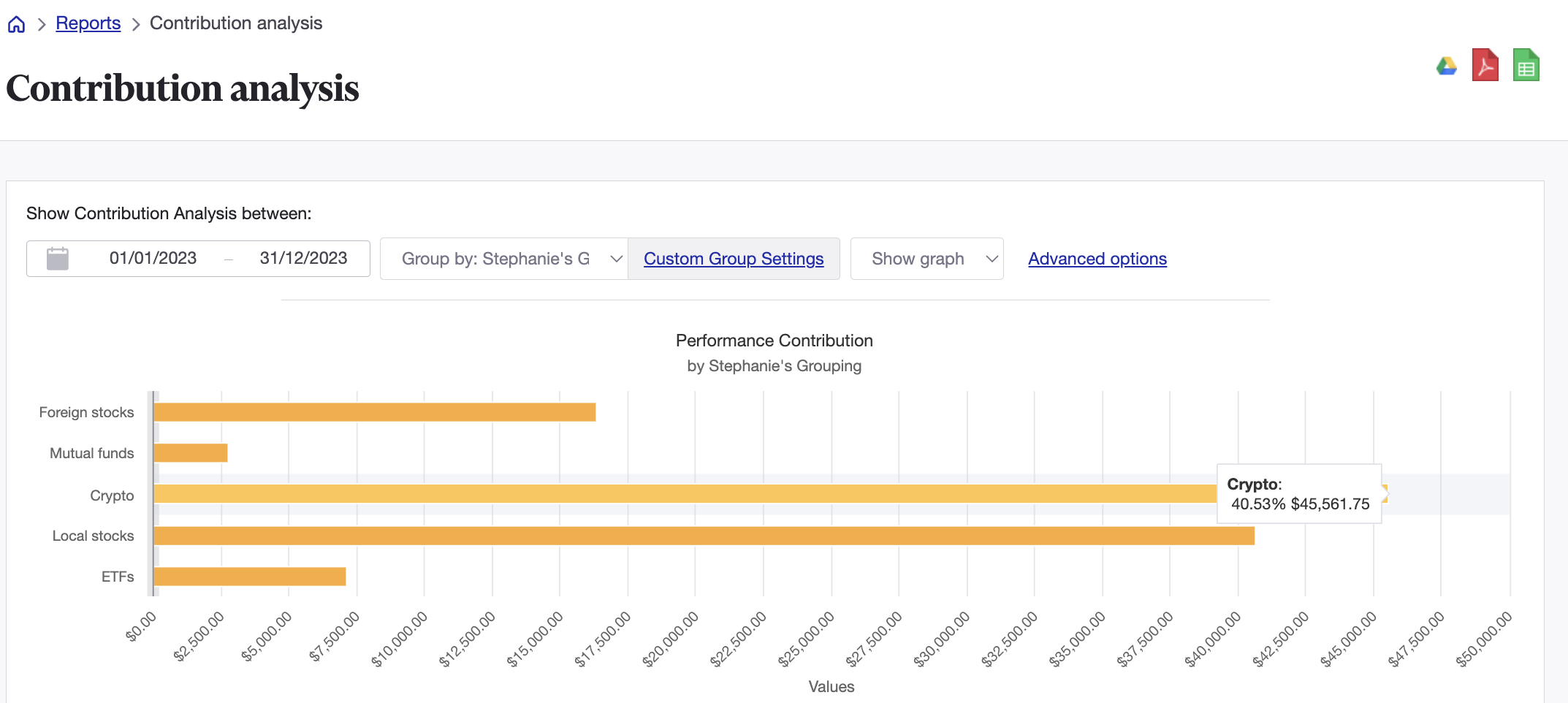

Once you have determined your asset allocation, you can run the contribution analysis report (available on Investor and Expert plans) to see how your asset classes are performing relative to each other. This can be done over the time period of your choice, and is a good way to evaluate the success of your investment strategy and see whether you need to rebalance your portfolio.

The contribution analysis report makes it easy to see how your different asset classes have performed relative to each other over your chosen period.

The contribution analysis report makes it easy to see how your different asset classes have performed relative to each other over your chosen period.

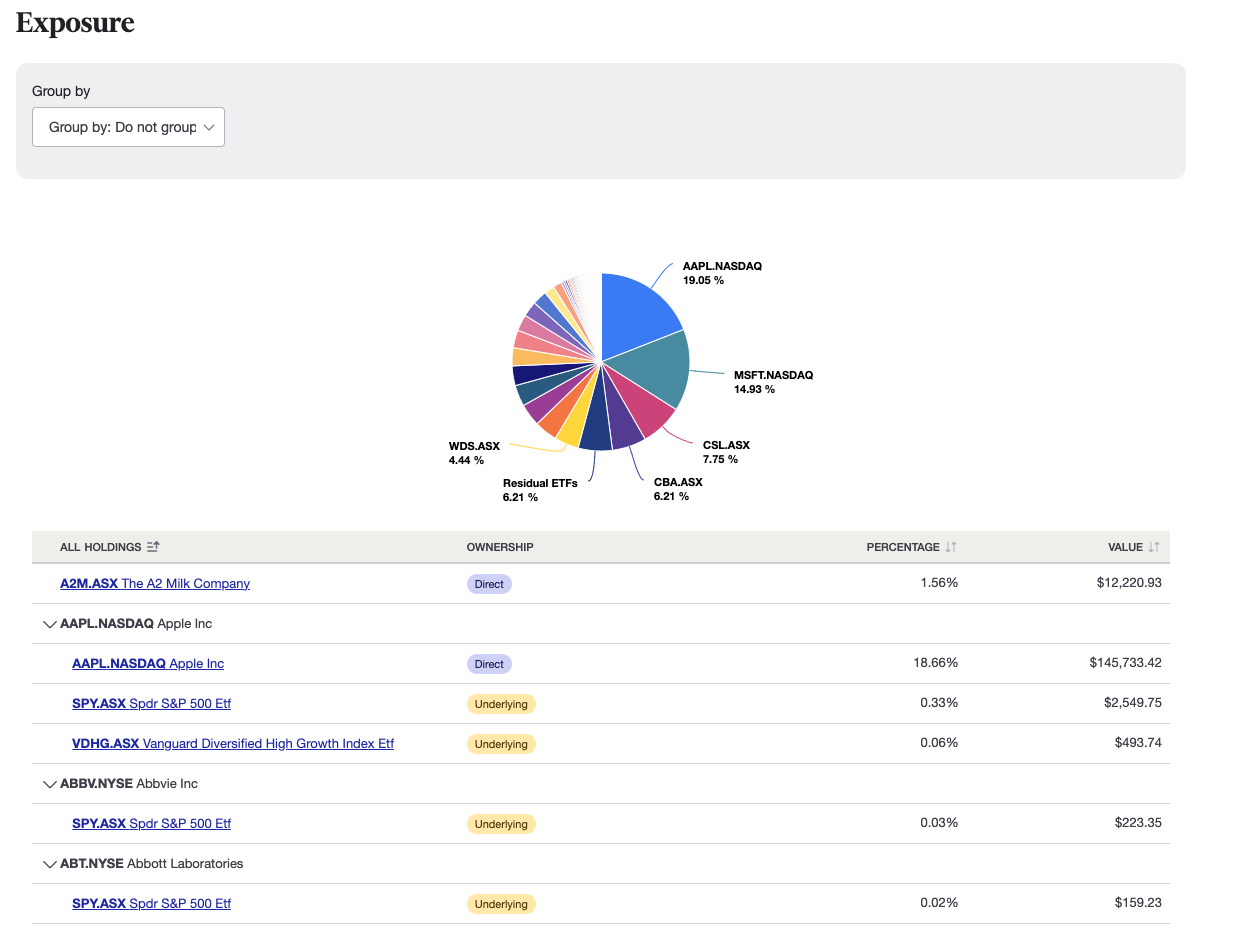

If you’re an ETF investor, another useful portfolio rebalancing tool is Sharesight’s exposure report (also available on Investor and Expert plans). The report displays your portfolio’s exposure to different industries, investment types and sectors by listing your direct stock holdings alongside any stocks held within exchange-traded funds (ETFs). This allows you to clearly identify any overlap in your portfolio, making it easier to diversify your portfolio by shedding any redundant stocks or ETFs.

The exposure report shows you the composition of your portfolio, including holdings that you own directly or as part of your ETFs’ underlying holdings, helping you avoid overlap in your holdings.

The exposure report shows you the composition of your portfolio, including holdings that you own directly or as part of your ETFs’ underlying holdings, helping you avoid overlap in your holdings.

2. Track your portfolio against a benchmark

Once you have evaluated your investment strategy and rebalanced your portfolio if necessary, it’s a good time to start tracking your portfolio against a benchmark. By benchmarking your portfolio against an index-tracking ETF, for example, you can track your portfolio against market trends. This allows you to determine whether your portfolio’s performance can be attributed to market conditions or your own investment decisions.

Investors can benchmark their portfolio against any one of the 500,000+ stocks, ETFs, funds and unit trusts Sharesight supports. Simply click ‘Add a benchmark’ on your portfolio’s Overview page and select the instrument that best reflects your asset allocation or investing strategy. As can be seen from the screenshot below, Sharesight makes it easy to see where your portfolio diverges from the benchmark. In this case, for example, you may decide to alter your investing strategy or even invest your money in the benchmark ETF rather than continuing to pick stocks.

An example of an investment portfolio that is underperforming and diverging from its chosen benchmark.

3. Review and track your dividends and distributions

If you invest in dividend-paying stocks, it’s important to have a way to keep track of all your dividend and distribution statements. You could keep track of them in a spreadsheet, but the ability to track them automatically makes it much easier to be a prepared investor, especially when tax time rolls around.

With Sharesight, dividends and distributions are automatically tracked in your portfolio, including dividend reinvestment plans (for AU and NZ investors). Once you’ve added all your holdings to Sharesight and set up any DRPs you may have, all you need to do is log in to Sharesight and verify and accept your dividend and distribution payments as they come in.

Another useful feature for dividend investors, Sharesight’s future income report (available on Investor and Expert plans) allows investors to see all of their upcoming announced dividends. This makes it easy for dividend investors to track their monthly dividend income and project their short-term cash flow.

The future income report is designed to help you keep track of upcoming dividends (as shown above), but you can also run it over past periods to give you a consolidated record of all the dividends you have received.

4. Get ready ahead of tax time

For many investors, getting ready for tax time can be somewhat of a nightmare, requiring you to track down a mixture of paper and digital statements, often from more than one share registry. This is known as "shoebox syndrome" and it’s just as inconvenient for accountants as it is for investors, what with all the back-and-forth communications about the various statements and receipts required to file a tax return.

Investors can save time (and potentially money) by keeping track of all their records in Sharesight throughout the year. Trades and dividends are automatically tracked in Sharesight, but investors also have the option to attach files such as trade confirmations and dividend statements to the holdings in their portfolio. This makes it much easier to verify these records at tax time before sharing the information with an accountant.

Sharesight also has a range of convenient reports designed to help investors prepare for tax time:

-

Taxable income report: See all dividend, distribution and interest payments received during any selected period.

-

Capital gains tax report: Calculate capital gains from a CGT perspective (for Australian and Canadian investors) over any selected period. Available on Starter, Investor and Expert plans.

-

Unrealised capital gains tax report: Calculate unrealised capital gains at any date to model tax loss selling scenarios and determine your unrealised CGT liability. Available on Investor and Expert plans.

The taxable income report shows a breakdown of any local or foreign investment income you have received over your chosen period.

More tips on staying prepared this year

For more detailed tips on how you can use some of the features mentioned in this blog, see our video below: Embedded content: https://www.youtube.com/watch?v=k-5Fh5ZUJT0

Become a prepared investor – track your portfolio with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to track their portfolio and make smarter investment decisions. Sign up today so you can:

-

Track all your investments in one place, including stocks in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

-

Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.