3 reasons why dividend tracking is crucial

Income received from stock dividends is a critical part of household income and retirement planning for millions of investors. In an age of extra low interest rates, listed companies paying healthy dividends are one of the last places you can find meaningful yield.

Merely counting up the cash you receive from dividends doesn’t go far enough. Dividends must be factored into the bigger picture -- your overall investment performance. To be successful, every dividend investor needs to understand:

- How to properly track the cash you receive

- The tax implications

- The impact of dividend reinvesting

Let’s look at my holding in Australian telecom giant Telstra (ASX:TLS) to illustrate.

![]()

The cash you receive

This is what dividend investing is all about, but it’s an admin nightmare. Listed companies, ETFs, and managed funds pay registries to track who owns how many shares, but also to dispense dividends. For my Australian portfolio, I’m forced to use three separate registries. This means three logins, three types of snail mail, three types of email alerts, and three sources of dividends that need to be manually compiled at tax time.

In the case of Telstra, the registry electronically debits the dividends to my bank account. This is handy (some companies send paper cheques), but even though it’s deposited in the same institution that I use for brokerage, the broker has no visibility across this data so they can’t calculate my dividend yield.

Sharesight automatically receives dividend info from the stock exchange, so your dividend yield will be up to date regardless of how and where you actually receive the cash. In Telstra’s case dividends make up two-thirds of my total return, which I can see in percentage and dollar terms:

![]()

And I can see each dividend received going back to my first investment in the stock:

![]()

The tax implications

Dividend income is typically taxed at the same rate as ordinary income, depending on entity type and your home country. Regardless, this means more admin pain.

Checking your bank balance won’t help because you’ll only see the net amount. The registry is a the official source for dividend tax implications, but they fall short in two ways. One, you’ll need to rely on multiple registries to compile a portfolio-wide tax picture. Two, they only provide one year’s worth of data and charge you a lot of money to access prior year information.

Sharesight receives the same information as the registries (minus the official statements). Checking the March 2017 Telstra dividend shows just how much detail it captures automatically. You can see that Sharesight has already split-out the franking credits. Any other fields, such as withholding tax, will be automatically filled in where appropriate:

![]()

Using the Taxable Income Report gives you a portfolio-wide view for a date range of your choice. Handily, this report separate non-trust from trust income as well as domestic from foreign income:

![]()

The impact of dividend reinvesting

Automatically reinvesting dividends is a useful way to top up your portfolio and keep yourself as fully invested as possible -- assuming you don’t need the cash. Some companies offer this via their registry. Unfortunately, dividend reinvesting brings an entirely new set of admin challenges for investors.

First, your broker will have no idea that you’ve enrolled in a dividend reinvestment (DRP) plan since they don’t handle these transactions. Second, each dividend is reinvested at a specified amount and price. These facts combine to mean that your cost base and amount invested are constantly changing. It’s essentially impossible to calculate your true performance.

Sharesight lets you enrol an entire holding into a dividend reinvestment plan, or reinvest specific dividends. It also automatically tell you the number of shares and reinvestment price:

![]()

Now every dividend received will be used to repurchase shares in the company, which Sharesight automatically factors into its performance calculations:

![]()

We’ve previously discussed the importance of properly tracking your investment performance, but tracking the dividends you receive is just as crucial to your success as an investor. For a stock you’ve held for a long period of time that pays significant dividends you’ll eventually want to compare your total income to the cost base. In the case of my Telstra shares, a quick check of the Historical Cost Report shows me that over time my Telstra purchases total $4,463.83 whereas the total income received from dividends is $2,669.32. Not too much longer until Telstra pays for itself!

Track your dividends for FREE

The best way to understand what Sharesight is all about is to sign up for a FREE account, add your holdings, and watch as your dividends are automatically populated -- going back up to 20 years!

FURTHER READING

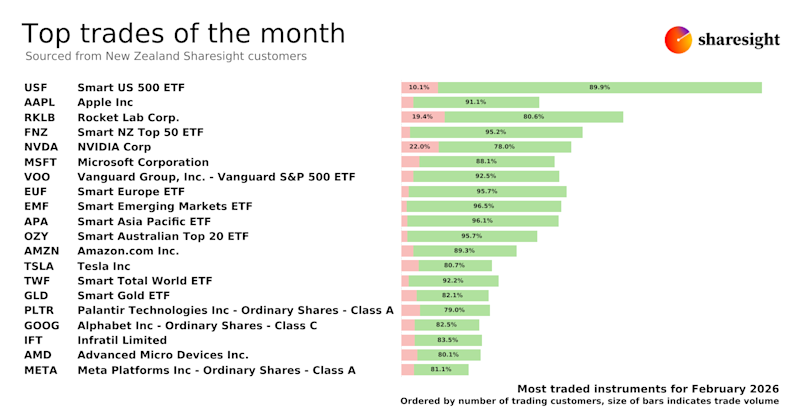

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

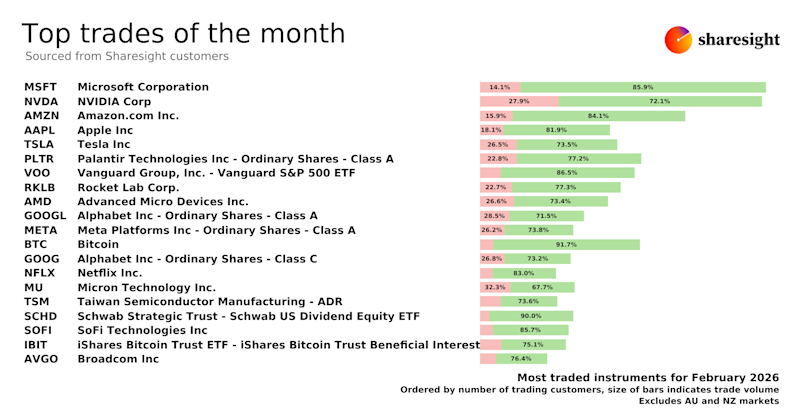

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

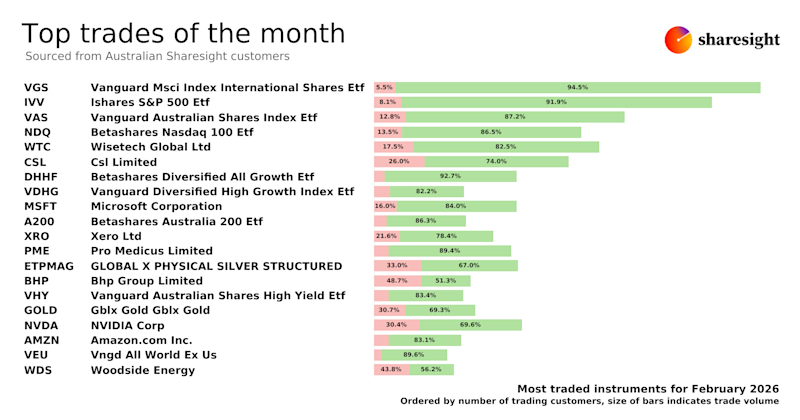

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.