3 easy ways to automate your portfolio admin

Investors tend to fall into two camps when it comes to staying on top of their investment portfolios. They either attempt to track every minor detail and metric in a complicated spreadsheet – or they don’t really bother doing it at all.

Don’t get us wrong – spreadsheets are awesome and certainly serve their purpose. But there are many reasons why you shouldn’t track your portfolio in a spreadsheet. Alternatively, if you’re not actively tracking and engaging with your portfolio, how do you know you’re making the most from your investments?

Sure, checking your online broker’s reports is a good start, but they often fail to incorporate the impact of things like brokerage fees, currency effects and corporate actions when calculating your return and don’t give you the full picture. (Here’s a real-life example of how an unreported share split made an investor think she was down -47.73%, when she was really up nearly 5%.)

See all your investments in one place

Like most things in life, the key to staying on top of your investments over the long run is to automate as many of the tedious admin tasks that eat up your time as possible.

The first step in automating your portfolio admin should be to sign-up for a free Sharesight account. Import your holdings (either your entire trading history or simply your opening balances), then sit back and watch as price and dividend data is updated automatically, so you can spend more time tracking your investment performance, and less on tedious admin tasks.

Once your portfolio is set up, you’ll want to automate as many of the day-to-day admin tasks as possible. Here are 3 easy ways to do that:

1. Track ongoing trades automatically

Keeping your portfolio up-to-date with your latest trades is a crucial step to staying ahead of your portfolio admin, as it ensures that your performance figures are accurate and allows you to make timely data-driven investing decisions. There are 3 ways to get your new trades into Sharesight:

Sync your brokerage account via Sharesight Connect

If you trade with any of the following brokers, then you’re in luck:

That’s because these brokers have partnered with Sharesight to allow their customers to automatically sync ongoing trades through the Sharesight API. Here’s how to connect one of those brokerage accounts using Sharesight Connect. And for those of you in Canada or the UK, stay tuned for upcoming Sharesight Connect broker integrations in your region.

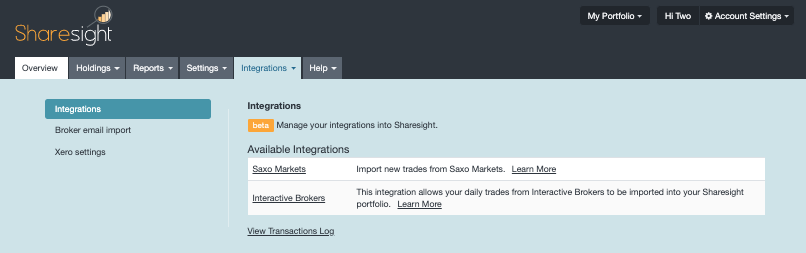

Connect your brokerage account through an integration

In addition to the Sharesight API, a number of custom integrations exist between Sharesight and online brokers that allow you to easily import trades to a Sharesight portfolio, including:

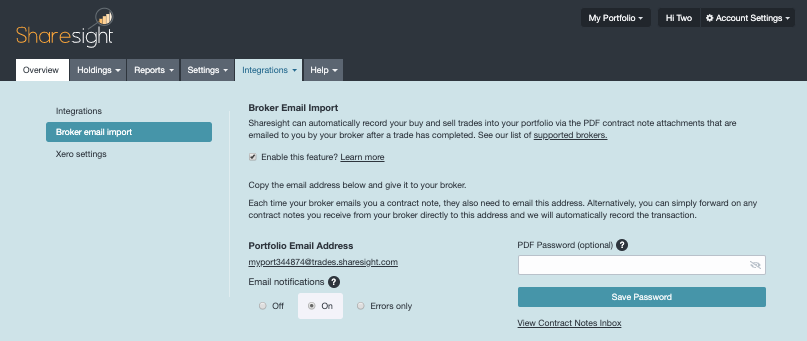

Import trades automatically from broker Trade Confirmation Emails

If your online broker provides Trade Confirmation Emails or you can download PDFs from your account of these trades, then you can forward those confirmations to Sharesight and we’ll automagically "read" the trade details from the contents and add the trades to your portfolio.

It’s just a matter of forwarding the emails to us, or including Sharesight as a recipient on your trade confirmation emails in your brokerage account. Learn more by visiting: Import trades via your broker’s trade confirmations. We currently support Trade Confirmation Emails from 100+ online brokers – If your broker's are not yet available in Sharesight, leave a message in our community forum if you’d like us to add support for your broker.

2. Keep up with corporate actions

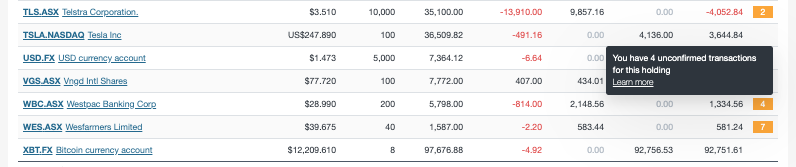

Sharesight automatically tracks the vast majority of corporate actions that occur throughout the year – including dividends and share splits. They appear as unconfirmed transactions on the portfolio overview or individual holding pages:

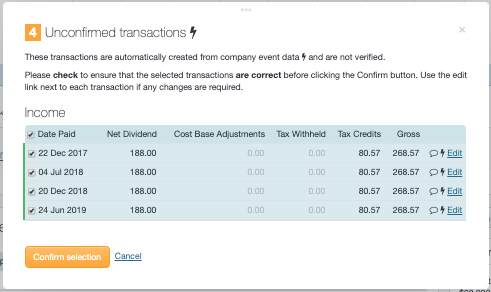

From the individual holding page, simply click on the unconfirmed transactions icon in order to review and confirm the transaction(s):

In the event of a complex corporate action which requires a decision on your part, you’ll need to manually adjust your portfolio according to your particular situation. Here’s how:

-

If you hold shares in a listed company that is wholly acquired by another listed company (with rollover relief), you can use our new Merge Holding feature to record the company merger in your portfolio.

-

See our collection of major corporate actions and how to handle them in Sharesight.

-

Visit our corporate actions help documentation for step-by-step instructions on how to handle other corporate actions in Sharesight.

We recommend reviewing your corporate actions on a monthly basis. This ensures the accuracy of your performance figures, and depending on the number of holdings in your portfolio (and how active they are in terms of corporate actions), it can save you a lot of time at the end of the year.

3. Track your dividend reinvestment plans (DRPs)

Speaking of dividends, if you’re partaking in a dividend reinvestment plan (also known as a DRP or DRIP), it’s especially important to properly track its impact on your portfolio. Sharesight makes it easy:

-

If you hold shares with companies listed on the ASX or NZX and have opted-in to their dividend reinvestment plan, then you’ll want to activate Sharesight’s Auto Dividend Reinvestment feature for the holding, which will automatically track a DRP by reinvesting all dividends. It will even let you automatically track the residual balances that can occur with some DRPs.

-

For shares listed on other markets, you can manually record a dividend reinvestment when you add or edit a dividend payment.

Either way, when a dividend reinvestment is recorded in Sharesight, a dividend reinvestment trade for the new shares is recorded in your portfolio, in addition to the dividend record. And your performance figures are updated accordingly.

Automating day-to-day portfolio transactions can save you hours of manual updates at the end of the year. And with everything always up to date and in one place, you’ll always know exactly how you’re doing.

Automate your portfolio tracking with Sharesight

Sharesight was built to make it easy for investors like you to spend more time investing and less time updating spreadsheets. Here’s how:

-

Automatically track your daily price & currency fluctuations, as well as handle corporate actions such as dividends and share splits.

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology.

-

Run powerful tax reports built for investors, including Capital Gains Tax (Australia and Canada), Unrealised Capital Gains, (Australia) and Taxable Income (All regions).

The best way to understand what Sharesight is all about is to sign up and try Sharesight for free. We’re confident that you’ll agree that it’s the best portfolio tracker for investors.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.