2017 stock picking competition — final results

Time for the final results of the Sharesight & Livewire 2017 stock picking competition!

Back in December 2016 we sent the call out for your picks for the 2017 calendar year and have been tracking the performance of the most popular picks from the Sharesight community, the Livewire readership, and some of Australia’s top fund managers throughout 2017.

What were the top picks?

Here are the portfolios for each group, which consist of the 5 stocks that received the most votes:

Sharesight community picks

| Company | Symbol |

|---|---|

| Altium | ALU |

| BHP Billiton | BHP |

| Retail Food Group | RFG |

| Sirtex Medical | SRX |

| Vocus Group | VOC |

Livewire reader picks

| Company | Symbol |

|---|---|

| Altium | ALU |

| BHP Billiton | BHP |

| Macquarie | MQG |

| QBE Insurance | QBE |

| Ramsay Health Care | RHC |

Fund Manager picks

| Company | Symbol |

|---|---|

| Altium | ALU |

| Centrepoint Alliance | CAF |

| Event Hospitality | EVT |

| GOOGL (Nasdaq) | |

| Imdex | IMD |

Performance

Who achieved the greatest return on their portfolio as at December 31 2017? The Sharesight clients, the Livewire readers, or the fund managers?

Even though all 3 portfolios owned Altium Limited (ALU.ASX) (which was the stand-out performer with a 66.98% return) and both the Sharesight and Livewire portfolios also owned BHP (BHP.ASX), there was quite a divergence in the performance across the 3 portfolios. The fund managers’ 34.58% return significantly outperformed the Sharesight portfolio at 5.78% -- however both the Livewire and fund manager portfolios beat the benchmark (STW.ASX) return of 10.40% for 2017.

There’s over a $145k difference over the $500k combined portfolios between the Sharesight and the fund managers’ portfolios – that’s significant:

| Portfolio | Total Return % | Total Return $ |

|---|---|---|

| Sharesight | 5.76% | $29,569.98 |

| Livewire | 21.34% | $108,876.98 |

| Fund Managers | 34.58% | $174,775.04 |

| Benchmark ASX 200 (STW) |

10.40% | $53,118.74 |

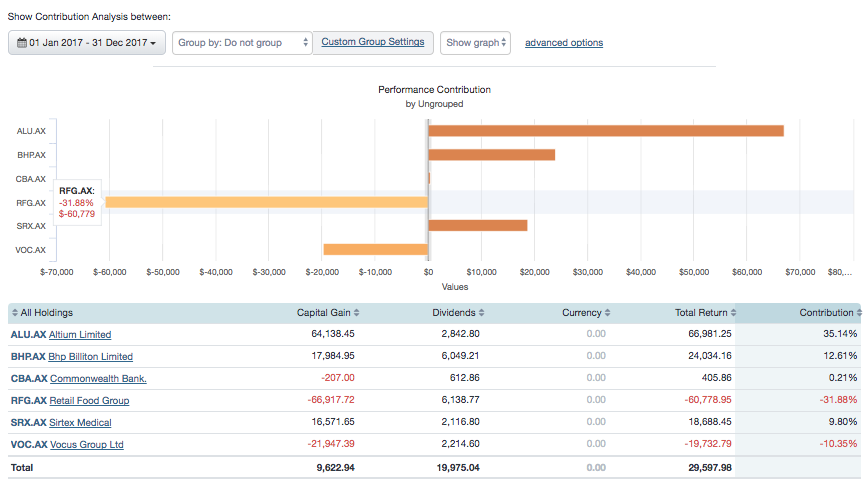

What explains these return

The Sharesight portfolio had the unfortunate chance of holding the 2 worst performing shares of the competition: Retail Food Group (RFG.ASX) which had a -58.28% total return, and Vocus Group (VOC.ASX) which had a -19.43% total return.

Retail Food Group had a horror run in 2017 after a number of scandals hit the company, which lead to repeated profit downgrades and saw it languishing at the bottom of the ASX200 index in December.

The top performer across all 3 portfolios was Altium Limited with a 66.98% total return in 2017.

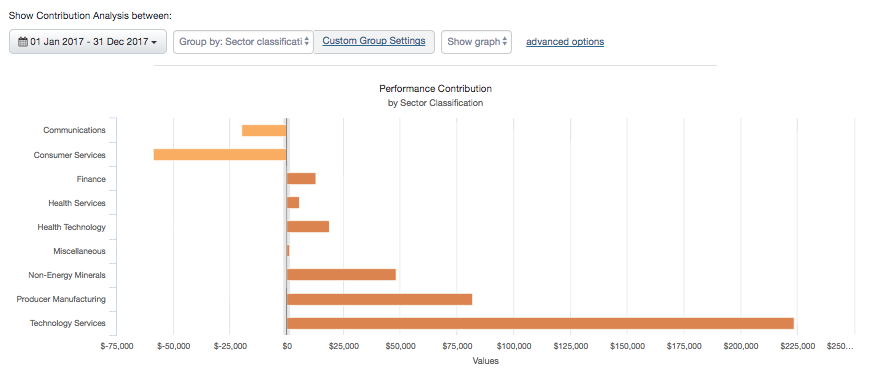

Using the Sharesight Contribution Analysis Report we ran an attribution analysis to determine what happened at the sector level across the consolidated view of all 3 portfolios:

Conclusion

The team at Sharesight would like to congratulate the fund managers on their winning portfolio performance in 2017, followed closely by the Livewire readers’ portfolio which almost doubled the performance of the ASX 200 for 2017.

Stay tuned this year for the Shareight 2018 Stock Picking Competition where Sharesight clients will be battling it out for the top global stock pick for 2018.

Portfolio notes

- We’ve “invested” $100,000 in each holding while assuming a brokerage fee for each buy transaction of $9.95.

- All dividends are/will be included in the total performance calculation, and are reinvested. Total performance also factors in currency effects.

- Performance figures are total return (versus annualised) as none of the portfolio positions has been held for longer than one year.

- The benchmark return figure assumes that all $500,000 was invested in the benchmark ETF.

All articles in this series

- 2017 stock picking competition

- 2017 stock picking competition - survey results

- 2017 stock picking competition - February update

- 2017 stock picking competition - April update

- 2017 stock picking competition - July update

- 2017 stock picking competition - October update

- 2017 stock picking competition — final results

FURTHER READING

Future focus: The perils of the new financial system

This International Women’s Day, Shani explores the risks of the new financial system, and how they mirror those of the established system.

Why investors are more informed, yet less confident than ever

More information doesn't always mean more confidence. Learn what's driving the client engagement gap and how advisers can close it.

Sharesight product updates – February 2026

This month's key focus was on the rollout of the new Investments tab to all users, along with various enhancements across web and mobile.